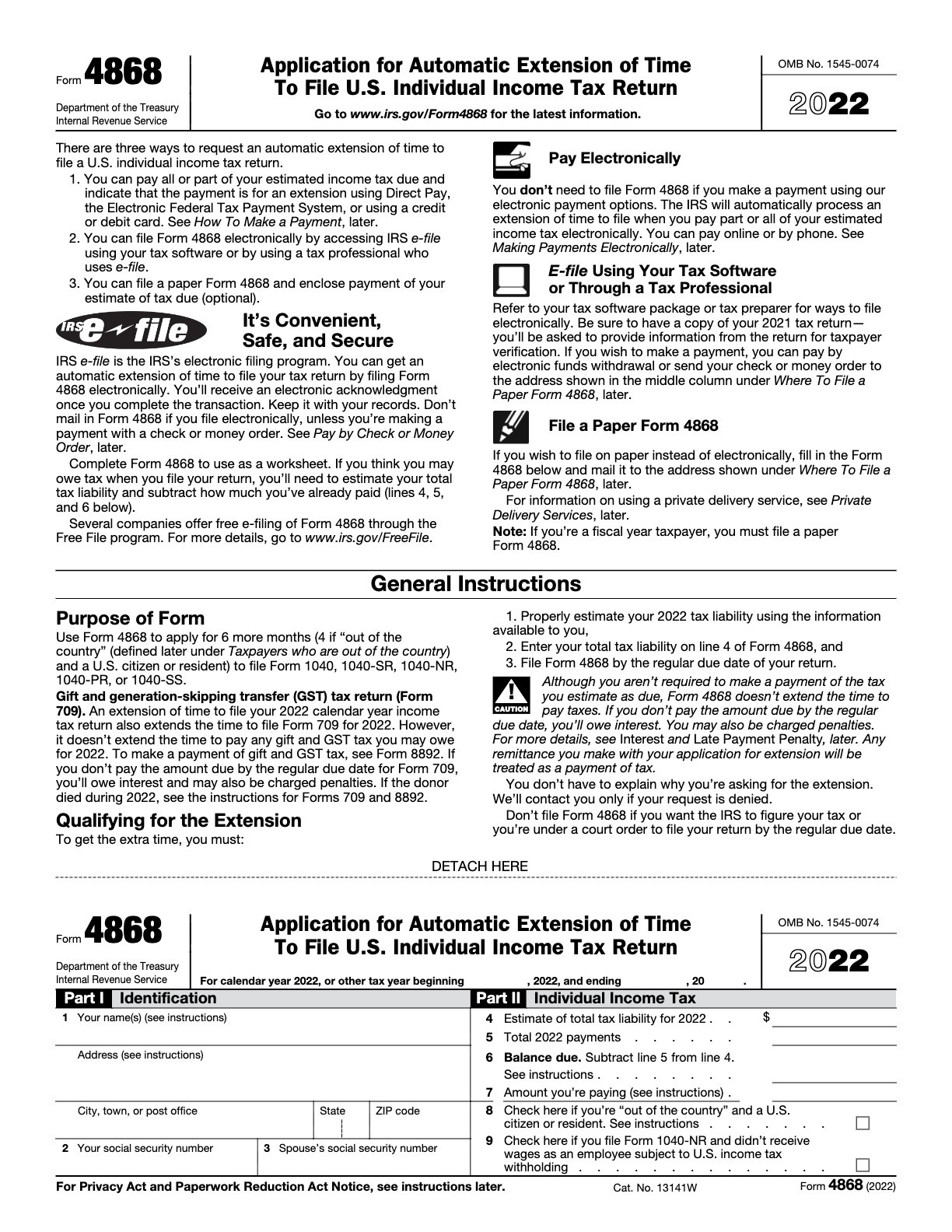

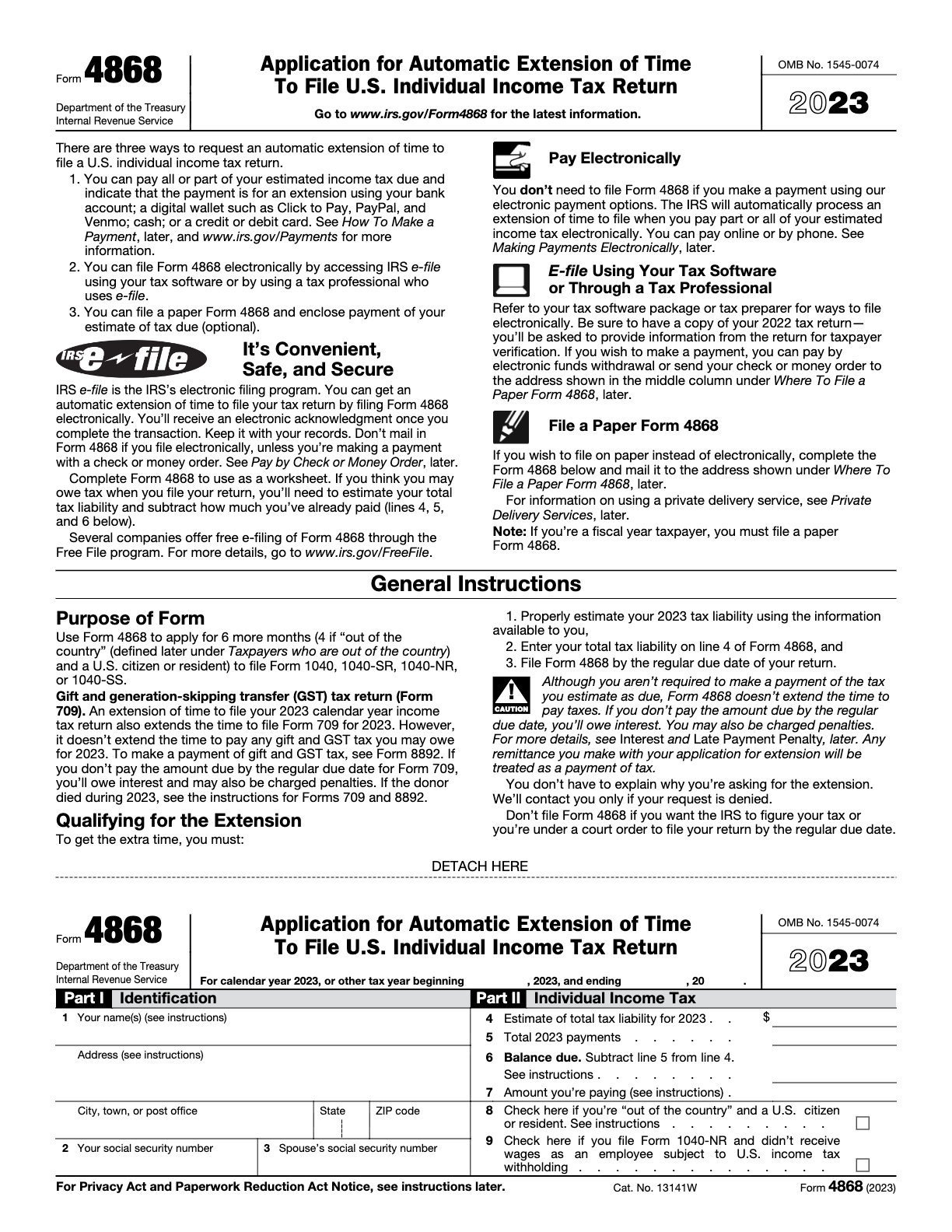

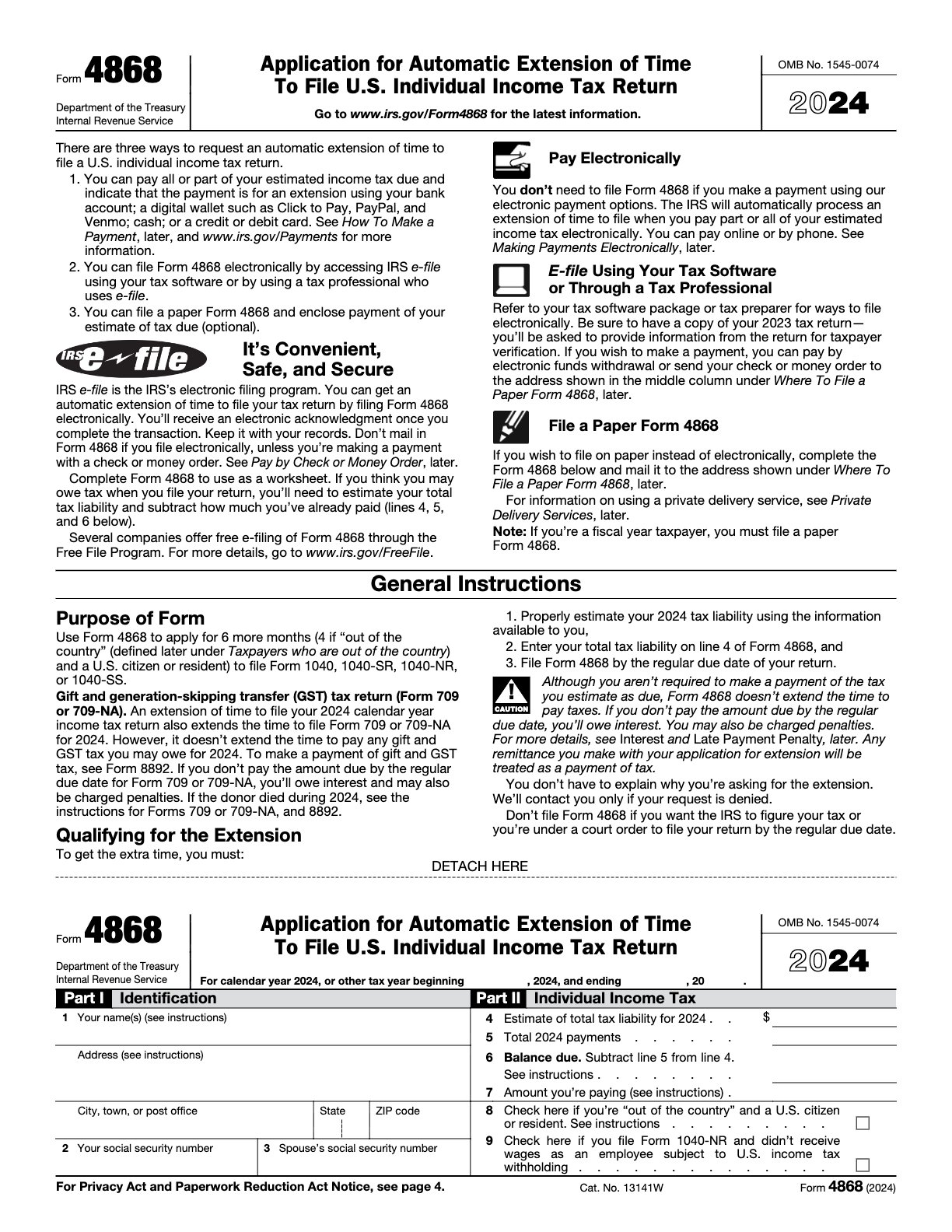

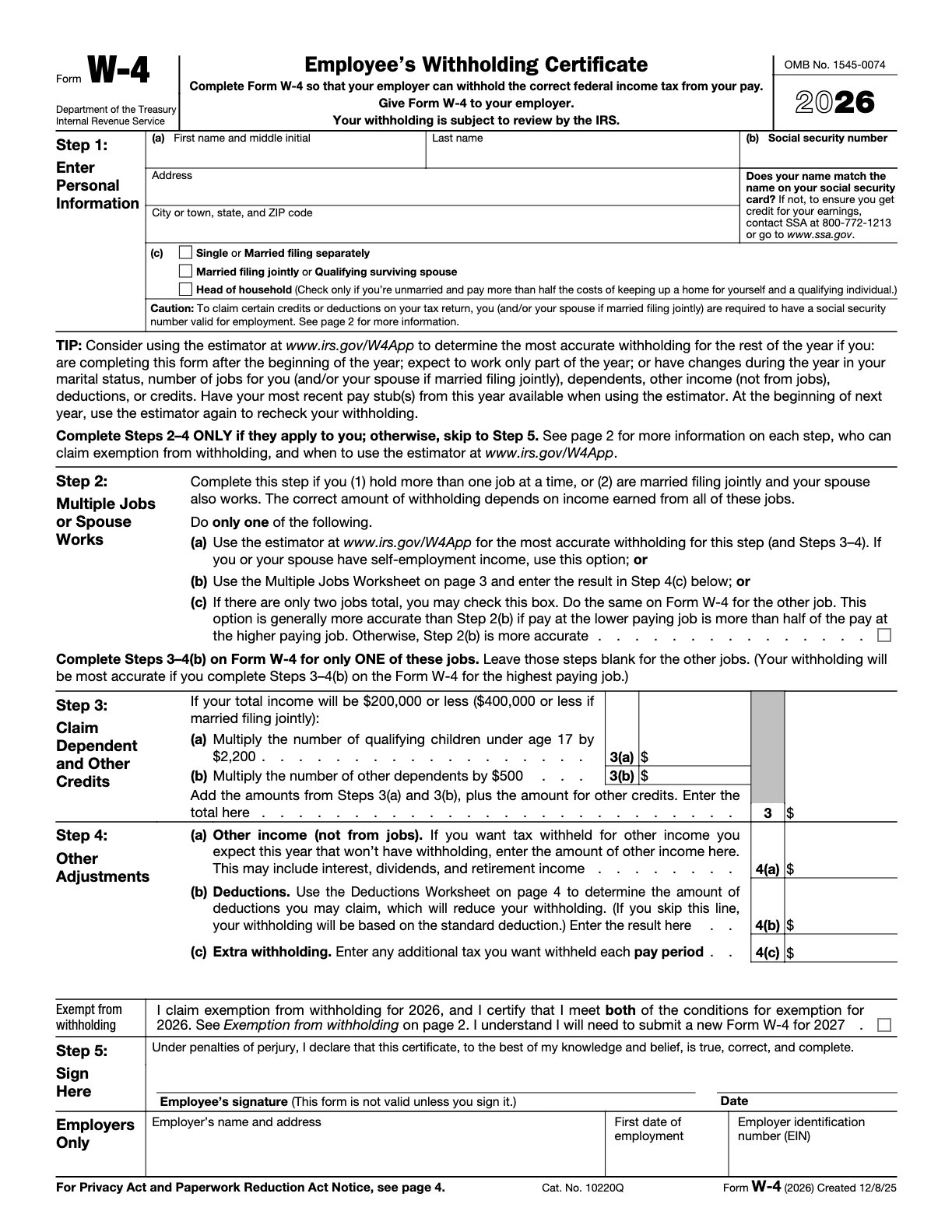

W-4

Employee’s Withholding Certificate - 2025

Employees complete Form W-4 when starting a new job or changing financial status. It helps employers withhold the correct amount of federal income tax.

Fill, Sign, and Share Your Forms in Minutes

Fill out your W-4 form

Click 'Fill this form' to be taken to our editor. Type directly into the form fields.

Digitally sign your form

Add your official signature to the form! You can draw, type or upload an image to sign.

Share your form instantly

Download, print, fax, or share your form with a direct link.

What is a W-4 form?

Employees complete Form W-4 when starting a new job or changing financial status. It helps employers withhold the correct amount of federal income tax.

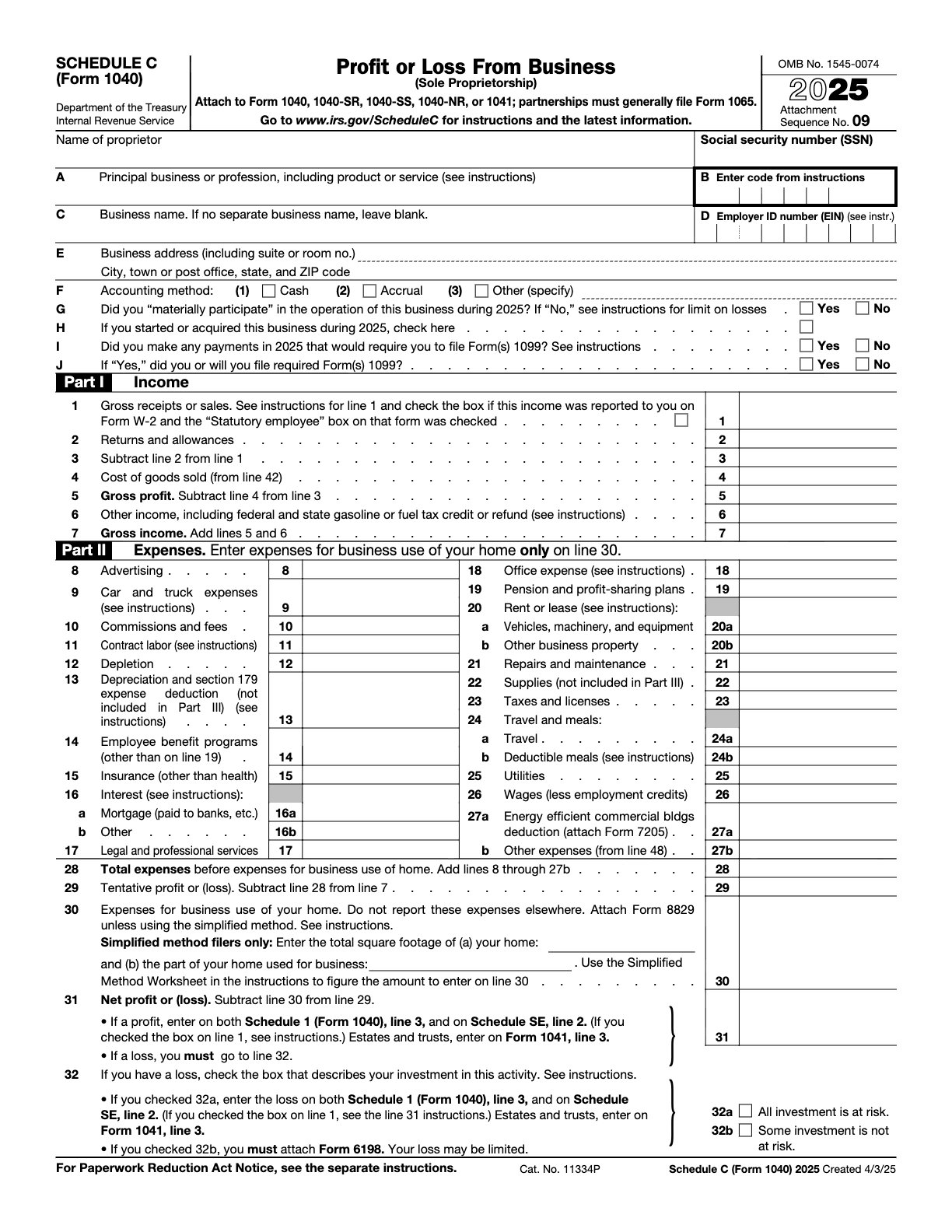

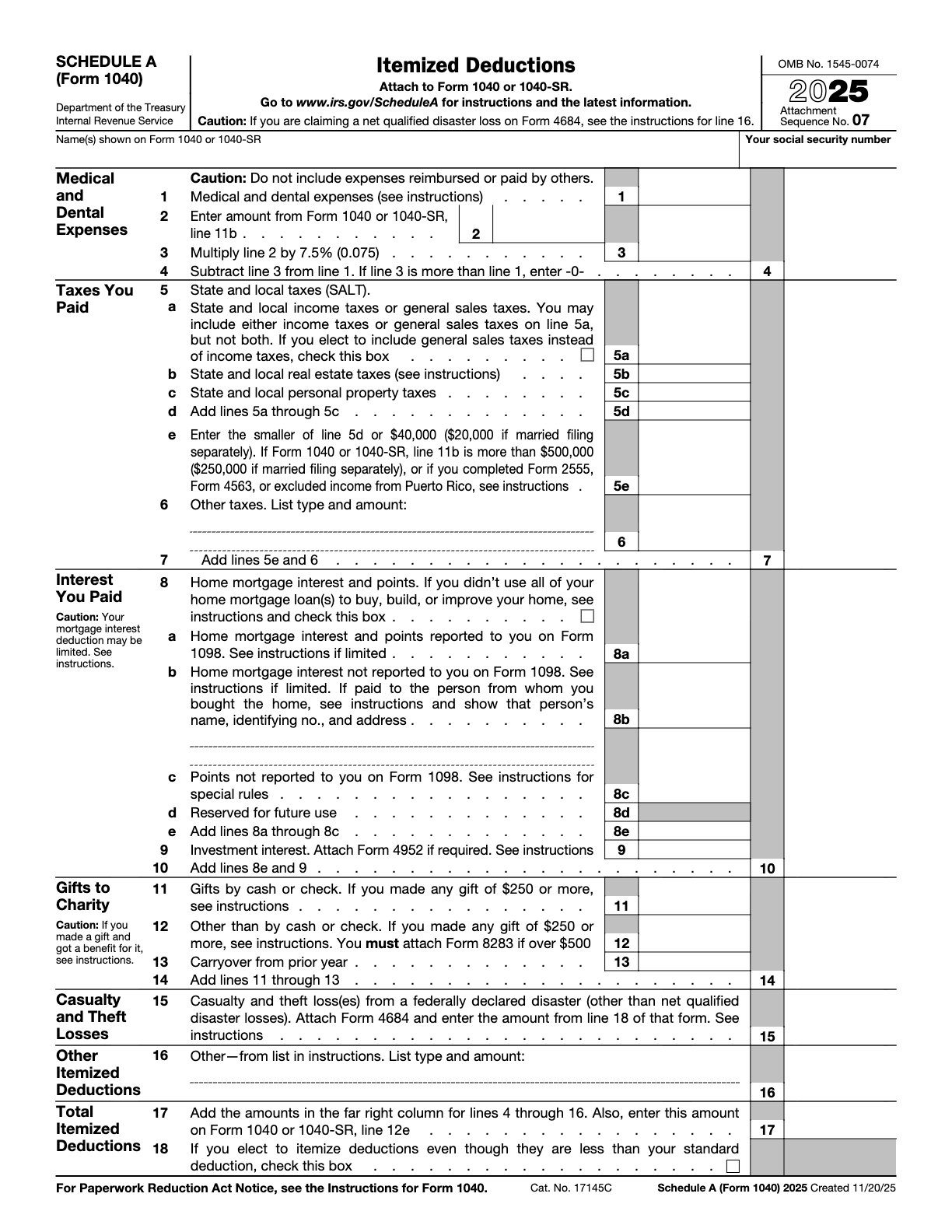

- Gather income statements (W-2, 1099, etc.) and supporting documents.

- Fill out personal information (name, SSN, filing status).

- Enter income, deductions, and credits as instructed.

- Attach required schedules or forms.

- Sign and date the return.

- File electronically via IRS e-File or mail to the IRS address listed for your state.

- Keep a copy for your records.

Get More Done with PDF.live

PDF.live lets you download ready-to-use forms and complete them entirely online. Edit text, rearrange pages, sign documents, add images, and more — no software required.

Full-Featured PDF Editor

Fill forms, edit text, add images, draw, highlight, and annotate PDFs in just a few clicks.

Start Now, Finish Anytime

Save your progress and return anytime. Your documents stay editable until you’re ready to finish.

Unlimited Document Storage

Securely store all your forms and documents in one place for easy access, updates, and reuse anytime.

Ready to get started?

Download the fillable W-4 form now and streamline your federal financial documentation process.